The health crisis propelled the electrically assisted bicycle or electric bike to the forefront. However, the demand subsequently fell sharply, leaving large stocks of electric bikes to be sold off. Today, search trends show that consumers are searching for more precise keywords, based on a specific brand or model – eg. Cowboy bikes, Speed pedelecs, and Fatbikes are in high demand. Bike leasing is also gaining interest, both in a professional and private context. This is revealed by an analysis from Universem, which studied internet searches in Belgium over the last 48 months, based on more than 13,000 keywords in French. How can brands take advantage of the opportunities revealed by these search trends?

After a peak in demand for electric bikes, a stabilization of searches

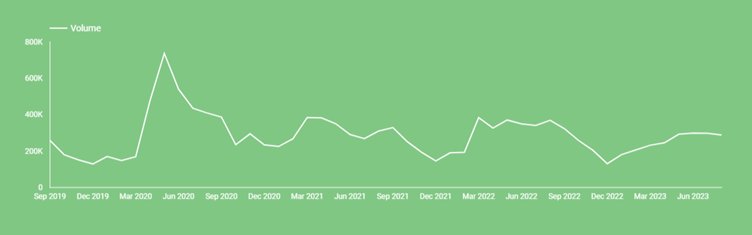

The electric bike sector is inevitably marked by a before/after March 2020 and the first Covid lockdown. The rush on bike stores during March and April of that year is still remembered, and this is of course reflected in web searches.

- April 2020 saw a search peak of +34%, and May an explosion of +67% compared to the average April searches over the target period (2020-2023)

- Generally, in 2020, the demand was marked by an increase in searches of about 35% compared to 2019. But it is also known that stocks did not keep up with this renewed interest – so sales probably won’t be entirely or directly correlated with this demand peak.

- The search trend then fell, and today is in decline by -35% in April and -32% compared to the average of the same month over the target period (2020-2023). Perhaps a sign of a more mature market, with deeper penetration of electric bikes into households?

While the sector faces some difficulties with these demand fluctuations, major online sales players could disappear or significantly restructure. For electric bike brands, retailers, and leasing companies, it is therefore essential to develop a clear, strong, and effective positioning in a highly competitive market. Here is how!

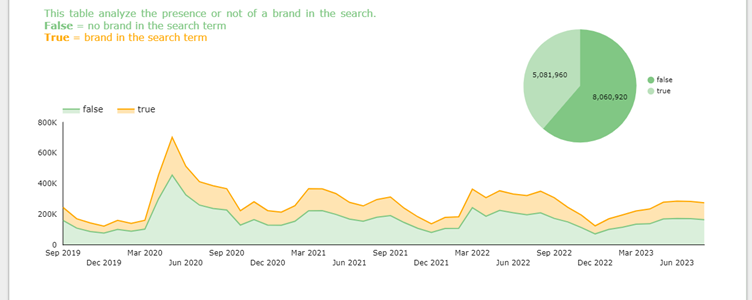

More specific queries, signs of a better market understanding

Generic searches (like “vélo électrique” – ie. “electric bike”) remain the majority but are decreasing compared to 2022. They are increasingly replaced by more specific searches:

- Either oriented towards a particular electric bike brand: “Brand” type searches represent 38% of queries. For example (for August 2023):

- “Vélo cowboy” (“Cowboy bike”): 1300 searches

- “Vélo Kalkhoff” (“Kalkhoff bike”): 210 searches

- Or focused on technical specifications or a particular model. For example (for August 2023):

- “Speed pedelec“: 12,100 searches

- “VTT électrique” (Electric mountain bike): 3600 searches in August 2023

- “Vélo pliant électrique” (Folding electric bike): 590 searches in August 2023

- “Speed bike 45km h“: 210 searches in August 2023

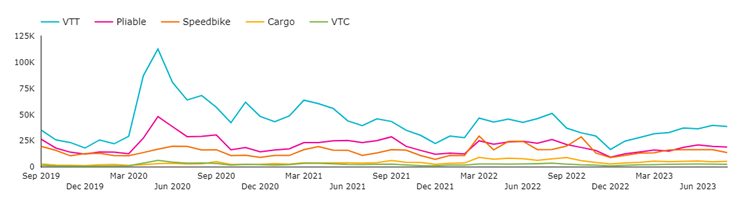

Mountain bike + electric, it’s a match!

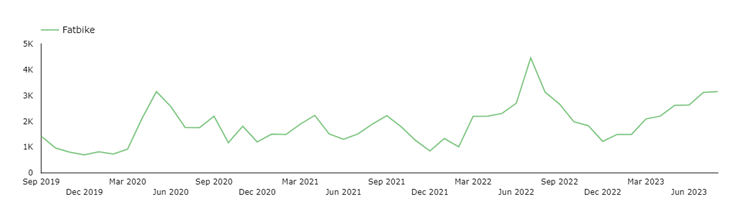

Electric mountain bike enthusiasts are characterized by even more specific searches than those looking for an electric bike. For example, the keywords « VTT électrique descente » (electric mountain bike downhill), « VTT cross électrique » (electric cross bike), « VTTAE » (mountain bike with electric assistance), « VTT électrique tout suspendu » (full-suspension electric mountain bike), are regularly associated with searches for « VTT électrique » (“electric mountain bike”). But the keyword category that stands out the most is “Fatbike”. It is also one of the only categories where the search level is as high as during the 2020 peak.

The “fatbike” keyword category represents a smaller volume than the mountain bike, foldable, speedbike, cargo, and hybrid bike categories. But it’s the only category where the search volume is growing compared to the 2020 peak.

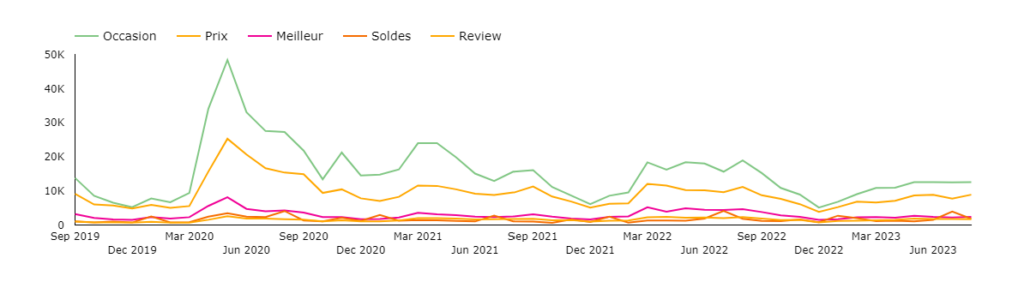

Opportunity and price, two strong arguments

Finally, when the user refines their search with specific criteria, it often focuses on finding an electric bike second-hand or at a good price, rather than on the quality of the bike.

What lessons for the SEO strategy of bike brands and retailers?

In case of low brand awareness, a long-tail strategy

“Branded” searches are a good barometer of a brand’s awareness. Well-established brands will naturally benefit from a volume of searches associated with their name. But for less known brands, the solution will be to position themselves on generic keywords. And since “vélo électrique (electric bike) is very competitive, the best strategy will consist of positioning on long-tail keywords – for example, “vélo électrique pour la plage (“electric mountain bike for the beach”). A good position on these keywords will, in the long term, also push the brand’s notoriety.

These different keywords must therefore be integrated to optimize the site’s pages, content, and metadata. The search intent they reveal should also help refine the audience, guide the copy of search and social network ads.

Specific landing pages and categories

To capture this traffic, players can think of landing pages perfectly configured for SEO and focused on the above-mentioned searches – for example:

- A landing page offering a selection of second-hand electric bikes and integrating the semantic field related to the “price” aspect. A more detailed analysis would determine this choice (e.g., “bon marché” vs.”pas cher”, “rapport qualité-prix”…)

- Or a landing page on a long-tail keyword like “VTT électrique” with information on the subject.

- This long-tail keyword can also be the subject of a product category in itself, corresponding to a search filter on the e-commerce site. This dual approach would thus target both informational and product intent.

Our teams can present this approach in more detail during a meeting.

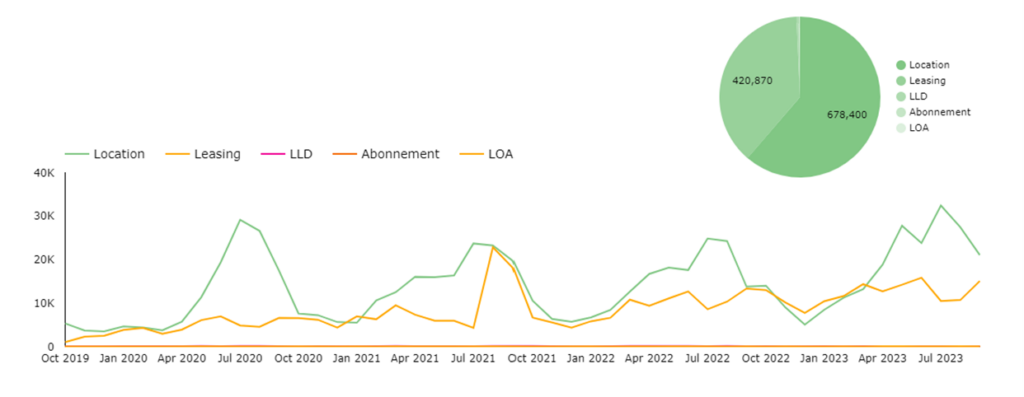

A clear growth in interest for bike leasing

Mobility within companies has changed a lot in recent years. Leasing searches saw a strong increase in 2023, with more than 260% growth compared to the pre-Covid period. However, while the increase is significant, the volumes remain low and very little linked to a specific brand.

Finally, searches related to leasing have also evolved in recent months: historically, it was associated with electric bikes (e.g., “leasing vélo électrique” – electric bike leasing) but today users mostly search for “leasing vélo” (bike leasing) without further details. A resurgence for muscle-powered bikes, or a normalization of electric bikes?

What lessons for the SEO strategy of electric bike leasing companies?

For bike leasing companies, this represents two major implications:

- Since the traffic is niche, it is also more qualified and offers more potential. Therefore, it is imperative to work to the maximum on its conversion into leads or appointments.

- Market players will benefit from working strongly on their generic positions (for example, on “bike leasing”). But to capture additional traffic, they will also need to broaden the semantic field to other types of searches (for example, alternatives like “location vélo” or “abonnement vélo”)

At Universem, our teams with a 360° vision work both on defining the best semantic field and on optimizing your landing pages, as well as the quality of the traffic generated.

To better understand some results, delve deeper into certain analysis angles, or understand how to improve your online presence, contact us for a first meeting.

Do you want to know all the details of this study, and discover the major trends in the field, as well as the positioning of brands such as Cube, Moustache, Trek, Cowboy, Ktm, Scott, Giant, BH, and more? Ask for our full report.

—-

Methodology

This study was conducted on 13,000 French keywords in the Belgian market around electric bikes and bike leasing: generic, brands, retailers, uses, etc. The keyword selection is based notably on the content of the websites of the largest electric bike retailers and brands in Belgium, as well as forums on the subject. The search tools used include Google’s Keyword Planner, SERanking. Data analysis was performed with BigQuery, and visualization with Looker Studio.